Frequently Asked Questions about Sukuk

Before starting to talk about Sukuk, we should first clarify the fundamental differences between corporate Sukuk and sovereign Sukuk in Egypt. Perhaps the most important of these is that the asset sold in a sovereign Sukuk is usufruct the asset and not the asset itself, as the right of ownership of the asset subject to the taskeek remains the property of the state. Also, sovereign Sukuk in Egypt are issued for the benefit of the Ministry of Finance only. Therefore, the term “Asset Ownership” will be used to refer to corporate Sukuk and “Asset Usufruct Ownership” will be used to refer to sovereign Sukuk in Egypt.

1. What is the definition of Sukuk?

Equal nominal value negotiable securities issued for a specified period, representing common shares in the assets/usufruct of the assets, as specified in the issuance prospectus.

2. Some aspects related to the issuance of sukuk

Linking sukuk to real assets:

-Sukuk must be backed by assets/usufruct of tangible assets (such as real estate, projects, goods, etc.) and not just debts or cash.

Determining the nature of sukuk and their relationship to the assets:

-The forms of the sukuk (ijarah, mudaraba, musharaka, or istisna’a) and the financial relationship between the sukuk holders and the issuing entity must be specified.

Legitimate use of funds:

-The funds resulting from the issuance of sukuk must be used in ways that comply with Sharia provisions and are reviewed by the Sharia Supervisory Committee, such as financing developmental projects.

Structuring contracts in accordance with Islamic Sharia:

-The contracts used in issuing the Sukuk must be compatible with the provisions of Islamic Sharia and reviewed by the Sharia Supervisory Committee.

Transparency:

-The issuer of the sukuk must commit to full disclosure of the nature of the investment, profit distribution mechanisms, associated risks, and other aspects related to the sukuk holders.

3. What are the most important forms of sovereign sukuk included in Sovereign Sukuk Law No. 138 of 2021?

A. Ijarah Sukuk:

They are issued on the basis of a contract that includes the transfer of the assets usufruct, concluded between the issuing entity and the sovereign Taskeek company, with the intention of leasing them to the issuing entity under a leasing contract. The suk represents a common share in the usufruct, and the return on these Sukuk is due from the lease value paid from The issuing entity under the lease contract.

B. Murabaha Sukuk:

They are issued on the basis of a Murabaha contract, and the proceeds of their issuance are used by the Sovereign Taskeek Company to finance the purchase of the usufruct to the Murabaha assets, from a supplier or owner, for the purpose of the Sovereign Taskeek Company selling this right to the issuing party. The Suk represents a common share in the ownership of the usufruct to the Murabaha assets after purchasing it from the supplier or owner, then in its price that must be paid by the issuing entity to the sovereign Taskeek company, and the return of these sukuk is the difference amount between the purchase price of the usufruct paid by the sovereign Taskeek company to the supplier or owner, and the price of its sale, which the issuing entity is obligated to pay to the sovereign Taskeek company, and the issuing party may sell the purchased usufruct to others.

C. Istisna’ Sukuk:

They are issued on the base of manufacturing assets for the purpose of selling or leasing the usufruct of these assets. The suk represents a common share in the ownership of the usufruct of the manufactured assets, the return from these sukuk is from the net lease value or the selling price of the usufruct or the amount refunded from the istisna’ payments when the purchase underwriting is implemented.

D. Wakala Sukuk:

They are issued on the basis of an agency contract in investing the usufruct of the assets, the sovereign Taskeek company is an agent for the investment, and the owners of the sukuk are the principals, the proceeds of the sukuk are the invested amount by the agent, and the sukuk represents a common share in the usufruct of the assets, the sovereign Taskeek company invests the assets by leasing it, the return on suk is the differences in value between the lease amount and the suk issuance price.

4. What is the difference between bonds, stocks and sukuk?

Sukuk are similar to shares: they both represent a common share in the ownership of assets/usufruct from income-generating assets, or participation in the capital of a profitable project.

The difference between sukuk and shares:

- Sukuk have a term in which they are liquidated in the manner stipulated in the issuance prospectus “Extinguishment of sukuk”. They are not permanent as long as the issuing company, as is the case with shares.

- Most of the forms of sukuk enable their holders to recover their capital upon the expiration of their term, regardless of the sukuk issuer asset value or his ability to pay his debts to others. While the shareholder has his share of the company’s assets upon liquidation (after paying its debts).

- Sukuk, in most of their structures, are an off-balance sheet financing tool on the part of the issuing company, while shares are a common stake in the company’s capital and the shareholder is the owner of the issuing company.

- The owner of sukuk does not participate in the management of the project, but the owner of the share can participate in the management.

- Sukuk are generally a low-risk security, while stocks are a higher-risk security.

Sukuk are similar to bonds: both are issued at a nominal value and have a maturity period.

The difference between Sukuk and Bonds:

- Sukuk are backed by assets/usufruct over real assets.

- The proceeds of the issuance of sukuk are used to develop projects, especially the development of the assets subject to sukuk.

- Sukuk are issued in different types, each type has a separate structure, and the assets, method of calculating the return, and trading rules differ according to each structure.

- None of the sukuk structure may include a text guaranteeing the instrument holder’s share in the assets or guaranteeing a lump sum return or a return proportional to the value of the sukuk.

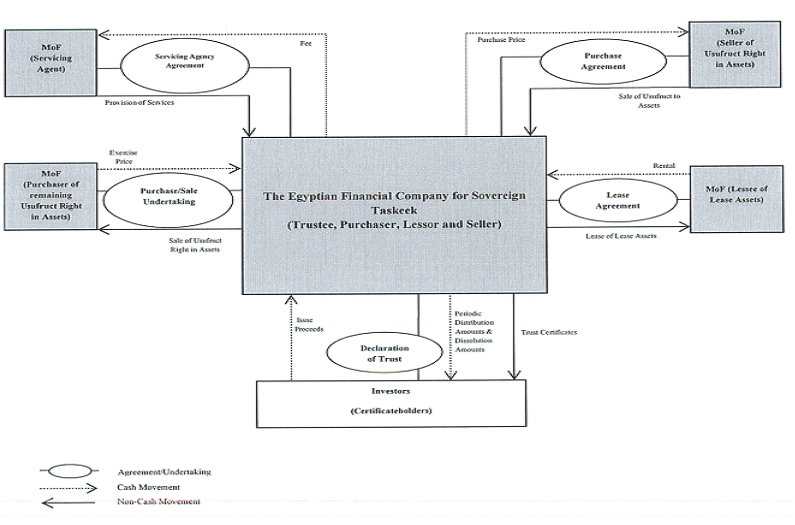

5. Who are the parties involved in the taskeek process?

- Taskeek Company:

A sukuk issuing entity that owns the assets, benefits, or projects subject to financing on behalf of the sukuk holders, transfers the proceeds of the funds to the beneficiary, acts as an agent for the sukuk holders, ensures the periodic payment of returns and the payment of the redemption value when the sukuk matures.

- Beneficiary:

The legal entity benefiting from the financing resulting from the taskeek process with the proceeds of the sukuk subscription and owning the assets, benefits, properties, project, and other rights. The Egyptian Capital Market Law has allowed certain entities, companies, bodies, and international or regional organizations to benefit from the financing by issuing sukuk themselves.

- Issuance organizer:

A bank, a licensed securities company, or any other financial institution licensed by the Financial Regulatory Authority to manage, organize, and promote the issuance on behalf of the beneficiary and the issuing party.

- Payment agent:

A bank licensed by the Central Bank of Egypt that acts as an agent for the issuing entity to coordinate the payment of the sukuk and pay their value at the end of the term to their owners or one of the companies licensed to practice the activity of depository and central registration.

- Credit rating agency:

A company licensed by the Financial Regulatory Authority to study the creditworthiness of the issuer of the Sukuk for the purpose of issuing a judgment indicating the extent of its ability to fulfill its obligations towards the sukuk holders. (This is with regard to corporate sukuk issuances).

While in the case of international sovereign sukuk, the sukuk is classified by international credit rating agencies.

- Custodian:

A company or bank licensed by the Financial Regulatory Authority to provide the service of managing the sukuk records from a financial and legal perspective, and undertakes the clearing and settlement of financial positions arising from the Sukuk trading operations and the registration of mortgage rights on it. The custodian also follows up on the dues of returns for the benefit of the Sukuk holders and submits periodic reports to both the sukuk issuing company or the beneficiary party, accordingly.

- Legal Advisor:

He is responsible for preparing contract and agreement models and determining the legal position of each step during the issuance period.

- Sharia Supervisory Committee:

It studies and approves the various aspects of the issuance from a sharia perspective, including approving the assets subject to taskeek and approving the issuance contracts, as well as verifying the continuity of dealing in the sukuk from the time of their issuance until their value is recovered in accordance with the principles of Islamic Sharia.

- The Supreme Evaluation Committee: “In case of issuing sovereign sukuk”

It is a committee of relevant experts that specializes in evaluating the usufruct or estimating the lease value of the assets on which sovereign sukuk are issued upon. The committee is formed based on the Prime Minister`s decision.

6.Who are the potential investors?

- Global banks and financial institutions that have included Sukuk in their investment portfolios and wish to invest in new markets.

- Islamic banks that seek short-term financial instruments that can be traded and at the same time comply with Sharia.

- A segment of individual investors who require financial transactions to be conducted with Sharia-compliant instruments.

- A large segment of Egyptians working abroad, especially those working in the Arabian Gulf region, who are awaiting the issuance of Sharia-compliant sukuk to invest in, given their influence by the success of the sukuk experiment in the outside world, especially in the Arabian Gulf region.

7. What are the risks to which Sukuk are exposed?

Sukuk are exposed to risks like any other security, and each sukuk has a credit rating from one of the approved rating companies. These risks include (legitimate – operational – legal – credit – market – exchange rate “for sukuk issued in foreign currency”), and they can be avoided by a good study and follow up on the performance of sukuk and adhering to the controls and instructions contained in the law, regulations and prospectus. There may also be a guarantor for the sukuk and an underwriter for coverage and recovery to transfer some of the risks.

8. What data does the Sukuk subscription prospectus include?

- -Taskeek company data.

- -Data of the beneficiary (issuing party).

- -Data on the Sharia Supervisory Sub-Committee.

- -The form of the contract used.

- -Data related to sukuk.

- -Description of the project financed by the proceeds of the issuance of the sukuk.

- -Sukuk credit rating.

- -Subscription data and procedures.

- -The bank as the payment agent.

- -Data related to the risks of issuing sukuk.

- -Data requested by the Financial Regulatory Authority according to the nature of the beneficiary or any forms of the instruments.

9. What is the role of Sukuk in achieving sustainable development?

- Sukuk can contribute to financing developmental projects in innovative and sustainable ways. The role of sukuk in achieving sustainable development can be summarized in the following

- points:

- -Financing development projects.

- -Promoting the green economy.

- -Attracting local and international investments.

- -Financial innovation.

- -Supporting the Islamic economy.

10. Could Sukuk be listed and traded on the stock exchange, and what are the listing conditions that must be met on the stock exchange?

Some structures of sukuk (including, but not limited to, ijara, mudaraba, and musharakah) can be listed and traded on the stock exchange, subject to the approval of the Sharia Supervisory Committee. Listing sukuk on the stock exchanges provides greater transparency, enhances their liquidity, and attracts both individual and institutional investors to participate.

11. What is the role and tasks of the taskeek company?

Sukuk are issued through a taskeek company that receives the subscription proceeds for the sukuk and acts as an agent for the sukuk holders in monitoring their investment and use for the purposes for which they were issued and as well as in monitoring the distribution of returns and their redemption value. The company is a party to all contracts with the benefiting of the financing and other participants in the issuance on behalf of the sukuk holders.

The tasks of the taskeek company include:

- -Collecting money from investors.

- -Follow up on the periodic returns due to the owners of these sukuk in accordance with the provisions contained in the issuance prospectus.

- -Follow up on the procedures for refunding the redemption value of the sukuk.

- -Monitoring the financial and operational performance of the project financed by sukuk to ensure achieving the expected returns.

- -Providing transparency and disclosure.

12. What is the role and tasks of the Sharia Supervisory Committee?

- -Approval the assets subject to taskeek, indicating their compatibility with the principles of Islamic Sharia.

- -Approving the issuance prospectus and all contractual forms for issuing sukuk, in a manner that indicates their compliance with the principles of Islamic Sharia.

- -Verifying the continuous dealing in sukuk from issuance until redemption in accordance with Islamic Sharia principles.

- -Approving the regulations related to taskeek, the issuance prospectus, and all contract formats for issuing sukuk within and outside the Arab Republic of Egypt, ensuring their compatibility with Islamic Sharia principles.

13. What is the group of sukuk owners?

- Egyptian law allows holders of a single sukuk issuance to form a group to protect the common interests of its members, and it shall have a legal representative from among its members, provided that it has no direct or indirect relationship with the issuer and has no interest that conflicts with the interests of the sukuk holders.

- The group’s representative shall take the necessary actions to protect the group’s common interests, whether in dealing with the issuer, the taskeek company, third parties, or before the judiciary, within the limits of the decisions taken by the group in its meetings.

2025 Copyrights ©